Your Cares act student loan reimbursement images are ready. Cares act student loan reimbursement are a topic that is being searched for and liked by netizens now. You can Download the Cares act student loan reimbursement files here. Find and Download all free images.

If you’re searching for cares act student loan reimbursement images information connected with to the cares act student loan reimbursement keyword, you have pay a visit to the right site. Our site frequently gives you suggestions for seeking the maximum quality video and picture content, please kindly hunt and find more enlightening video articles and graphics that fit your interests.

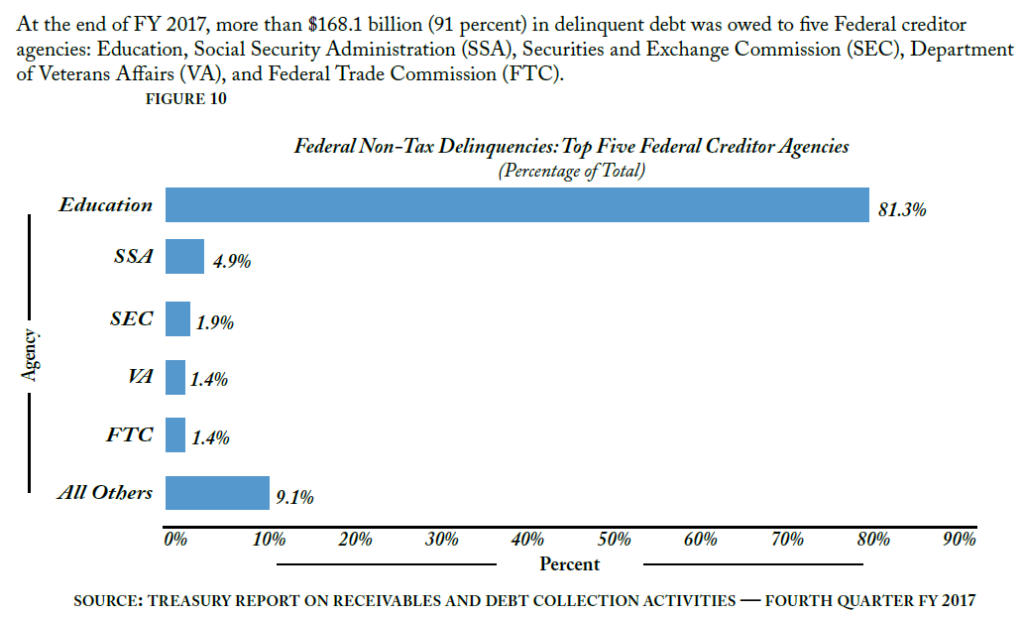

Cares Act Student Loan Reimbursement. TXT PDF All Actions Roll Call Votes. The funding package provides aid to higher. The percentage of student loan debt that became seriously delinquent the last step on the path to default was just 1 percent in the third quarter of 2021 according to data from the New York Federal Reserve likely all of it private loan debt. Passed the House on July 17 2019.

Collection Actions Student Loan Borrowers Assistance From studentloanborrowerassistance.org

Collection Actions Student Loan Borrowers Assistance From studentloanborrowerassistance.org

As Congress debates yet a fourth stimulus bill state lawmakers and governors have been doing the hard work of deciding how to spend the federal funds from the previous stimulus bill the CARES Act. Unfortunately private student loan borrowers do not qualify for the CARES Act 6-month payment pause. The Coronavirus Aid Relief and Economic Security CARES Act included a provision that allows employers to provide 5250 annually for an employees student loan repayment or tuition reimbursement through 2025. Design flexible programs that meet your workplaces specific needs. Federal student loan borrowers can take advantage of the pause in payments until September when theyll hopefully be in a position to advantage of the tax-free employer student loan assistance from October - December. She now has until December 31 2024 to take the entire balance because 2020 will not be counted in the 5-year period.

Theres an Apple University so its no surprise the company also covers some eligible formal education.

The American Rescue Plan ARP was passed by Congress and signed into law March 11 2021 and is the third round of funding under the Higher Education Emergency Relief Fund HEERF during the coronavirus pandemic. TXT PDF All Actions Roll Call Votes. C Maximum loan amountDuring the covered period with respect to any loan guaranteed under section 7a of the Small Business Act 15 USC. However for these payments to be excluded from taxable wages they must be made under a tuition assistance plan established under IRC Section 127 and meet the following. There have been 5 roll call votes. During 2020 the CARES Act allows employers to pay up to 5250 of their employees student loan debt and not treat the payment as taxable wages.

Source: ticas.org

Source: ticas.org

Section 2206 of the CARES Act amended Code Section 127 to allow an employer to pay for all or part of an employees Qualified Education Loan as. Other benefits include a GED reimbursement program and student loan refinancing. Theres an Apple University so its no surprise the company also covers some eligible formal education. However for these payments to be excluded from taxable wages they must be made under a tuition assistance plan established under IRC Section 127 and meet the following. As far as the eye can see the education must relate to advancing your career at Apple.

![]() Source: walberg.house.gov

Source: walberg.house.gov

That rate is a sharp dip from pre-pandemic years and will inevitably increase as interest rates rise from zero and. Section 2206 of the CARES Act amended Code Section 127 to allow an employer to pay for all or part of an employees Qualified Education Loan as. Employer-paid student loan debt. Have questions about the CARES Act or your RMDs. TXT PDF All Actions Roll Call Votes.

Source: coredocuments.com

Source: coredocuments.com

Make matching contributions to retirement plans when employees make student loan payments. The American Rescue Plan ARP was passed by Congress and signed into law March 11 2021 and is the third round of funding under the Higher Education Emergency Relief Fund HEERF during the coronavirus pandemic. However for these payments to be excluded from taxable wages they must be made under a tuition assistance plan established under IRC Section 127 and meet the following. 636a for which an application is approved or pending approval on or after the date of enactment of this Act the maximum loan amount shall be the lesser of 1 the product obtained by multiplying. Other benefits include a GED reimbursement program and student loan refinancing.

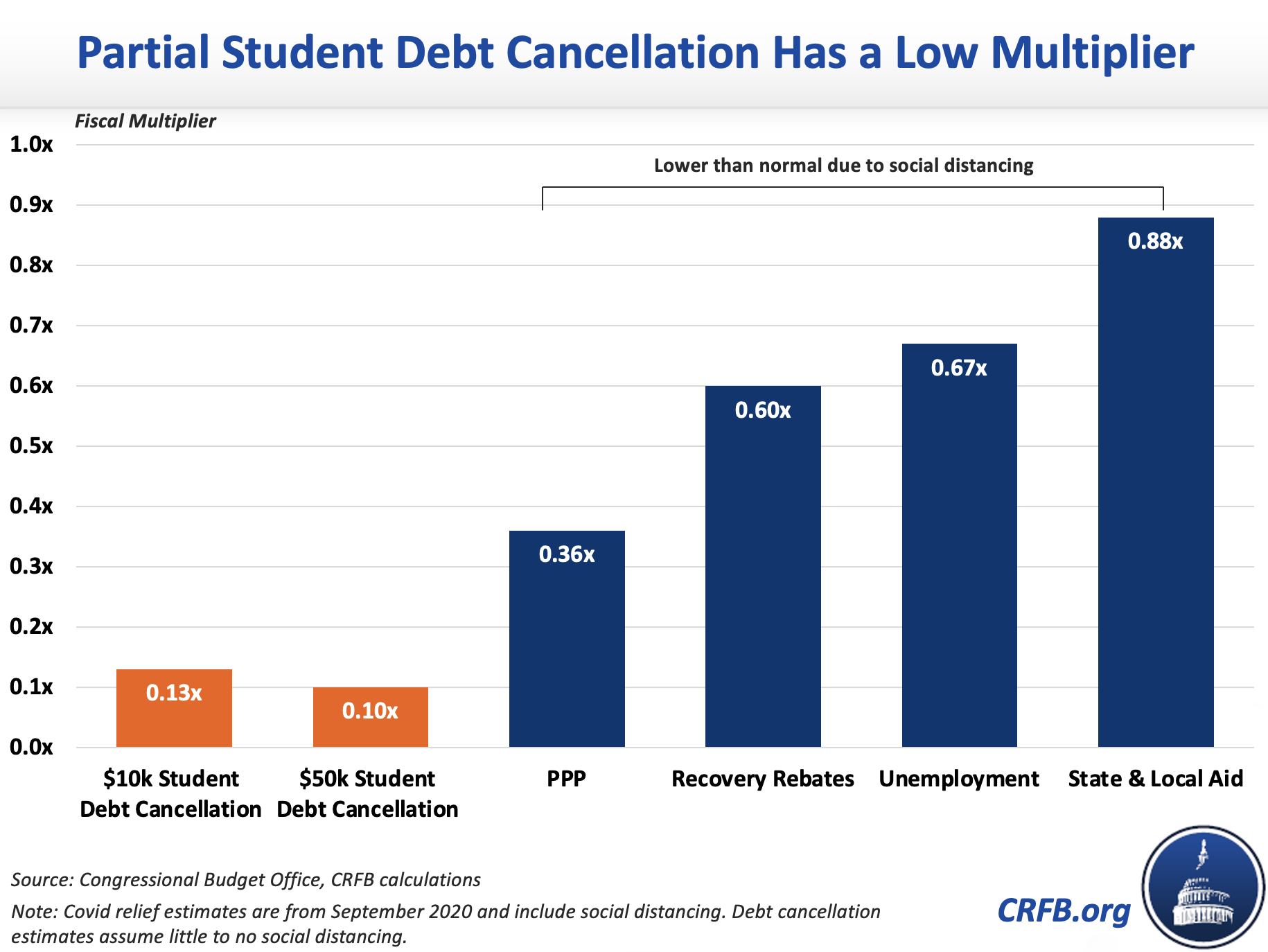

Source: crfb.org

Source: crfb.org

The CARES Act employer-based student loan relief is provided through the employers Section 127 Educational Assistance Program EAP which is established with a separate written plan of an employer for the exclusive benefit of his employees to provide such employees with educational assistance This plan document requirement is easily met with the Core 127 plan. Student Loan Repayment. During 2020 the CARES Act allows employers to pay up to 5250 of their employees student loan debt and not treat the payment as taxable wages. 03272020 Became Public Law No. As Congress debates yet a fourth stimulus bill state lawmakers and governors have been doing the hard work of deciding how to spend the federal funds from the previous stimulus bill the CARES Act.

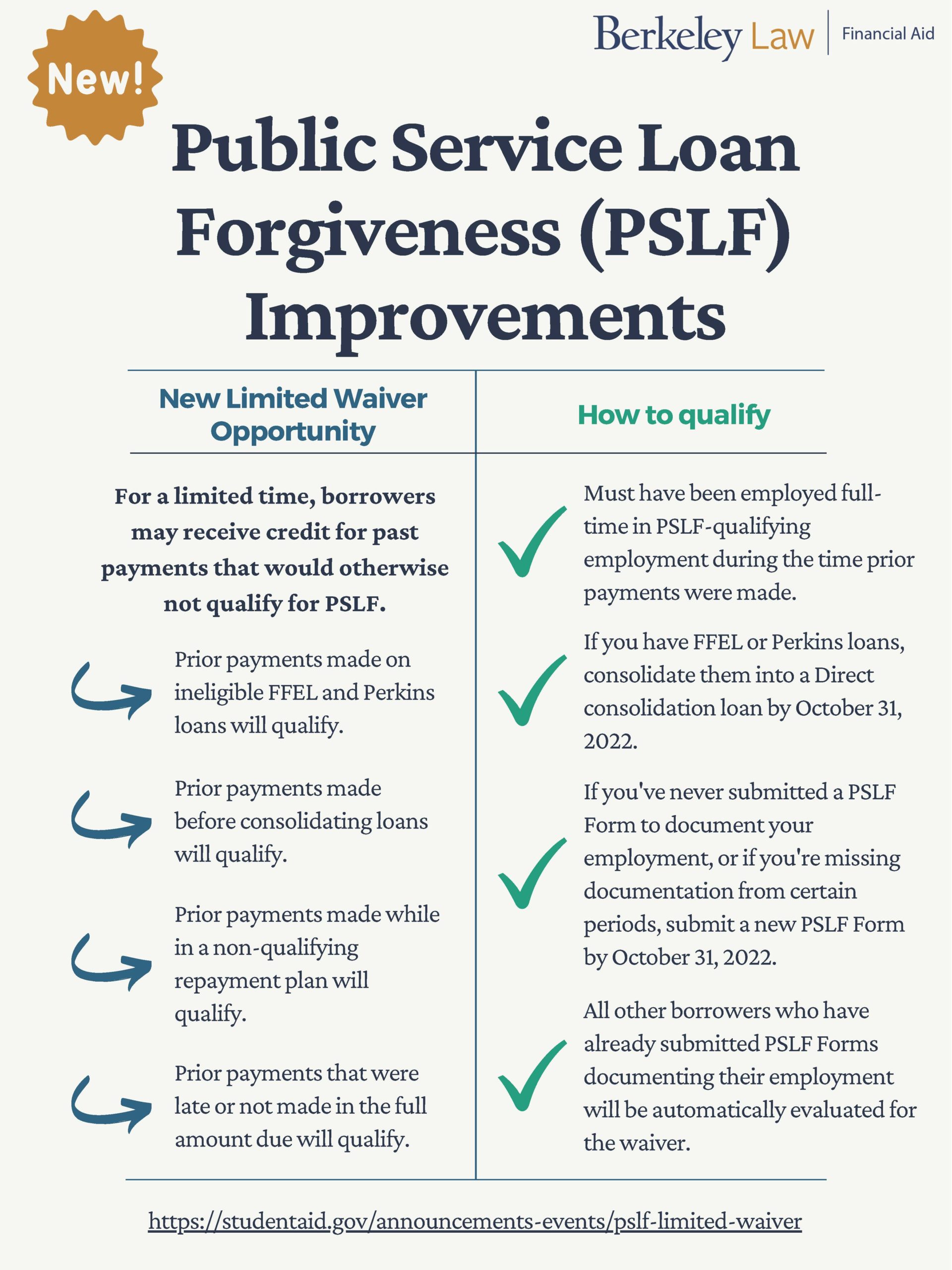

Source: law.berkeley.edu

Source: law.berkeley.edu

Make matching contributions to retirement plans when employees make student loan payments. House - Ways and Means. Student Loan Interest Deduction. Have questions about the CARES Act or your RMDs. It provided 150 billion in direct federal assistance for state territorial and tribal governments.

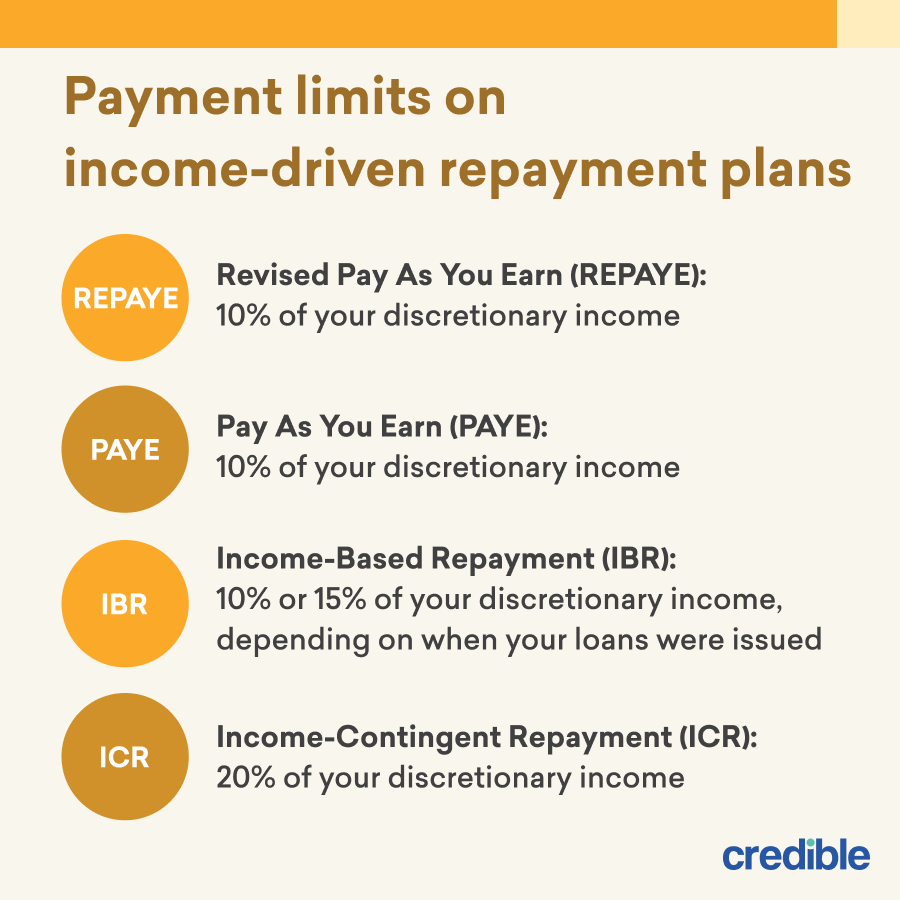

Source: credible.com

Source: credible.com

President Joseph R. The Consolidated Appropriations Act 2021 CAA passed at the end of 2020 extended the CARES Act student loan provisions to allow employers to make tax-exempt loan-repayment contributions of up. Then the company says it reimburses you for certain educational expenses including tuition. Make monthly or year-end true-up contributions to improve employee retention. Enrolled at least half-time.

Source: credible.com

Source: credible.com

The CARES Act. That rate is a sharp dip from pre-pandemic years and will inevitably increase as interest rates rise from zero and. Student Loan Repayment. Then the company says it reimburses you for certain educational expenses including tuition. Unfortunately private student loan borrowers do not qualify for the CARES Act 6-month payment pause.

Source: studentloanborrowerassistance.org

Source: studentloanborrowerassistance.org

TXT PDF All Actions Roll Call Votes. Student Loan Interest Deduction. Interest rates for qualifying student loan debt have been temporarily reduced to zero percent. As far as the eye can see the education must relate to advancing your career at Apple. C Maximum loan amountDuring the covered period with respect to any loan guaranteed under section 7a of the Small Business Act 15 USC.

Source: thecollegeinvestor.com

Source: thecollegeinvestor.com

03272020 Became Public Law No. At HR Block we want you to feel confident as you make financial decisions. 748 Middle Class Health Benefits Tax Repeal Act of 2019 by Joe Courtney D-CT on January 24 2019. TXT PDF All Actions Roll Call Votes. The CARES Act.

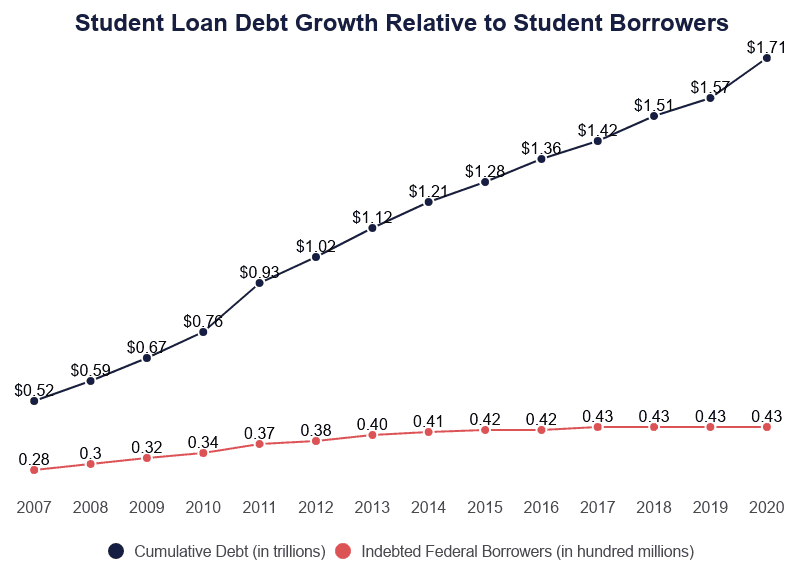

Source: educationdata.org

Source: educationdata.org

Every Student Succeeds Act ESSA. Every Student Succeeds Act ESSA. Then the company says it reimburses you for certain educational expenses including tuition. The percentage of student loan debt that became seriously delinquent the last step on the path to default was just 1 percent in the third quarter of 2021 according to data from the New York Federal Reserve likely all of it private loan debt. The American Rescue Plan ARP was passed by Congress and signed into law March 11 2021 and is the third round of funding under the Higher Education Emergency Relief Fund HEERF during the coronavirus pandemic.

Source: studentloanborrowerassistance.org

Source: studentloanborrowerassistance.org

The CARES Act employer-based student loan relief is provided through the employers Section 127 Educational Assistance Program EAP which is established with a separate written plan of an employer for the exclusive benefit of his employees to provide such employees with educational assistance This plan document requirement is easily met with the Core 127 plan. Courtney Joe D-CT-2 Introduced 01242019 Committees. Exploring the world of money and the impact that money decisions have on our everyday lives has always been more than just a job for me. Make monthly or year-end true-up contributions to improve employee retention. Before the CARES Act she would have been required to take the entire balance in the IRA by December 31 2023.

Source: ncsl.org

Source: ncsl.org

636a for which an application is approved or pending approval on or after the date of enactment of this Act the maximum loan amount shall be the lesser of 1 the product obtained by multiplying. Theres an Apple University so its no surprise the company also covers some eligible formal education. Unfortunately private student loan borrowers do not qualify for the CARES Act 6-month payment pause. It provided 150 billion in direct federal assistance for state territorial and tribal governments. The 116th United States Congress.

Source: ticas.org

Source: ticas.org

The 116th United States Congress. Fidelity Investments offers a 2000 reimbursement package distributed over five years to employees who pass the six-month mark at the firm. Interest rates for qualifying student loan debt have been temporarily reduced to zero percent. The CARES Act - Coronavirus Response and Relief Supplemental Appropriations Act 2021 is intended to help States and LEAs safely operate schools measure and effectively address learning needs and take other actions to mitigate the impact of COVID-19 on the students and families who depend on our public schools. Although there might be some student loan options available to you you might want to consider looking into hospitals that pay for nursing school.

Source: plansponsor.com

Source: plansponsor.com

Committee consideration by House Ways and Means. Federal Student Aid. President Joseph R. Other benefits include a GED reimbursement program and student loan refinancing. That rate is a sharp dip from pre-pandemic years and will inevitably increase as interest rates rise from zero and.

Source: educationdata.org

Source: educationdata.org

HEERF III Student Emergency Fund Information. Student Loan Repayment. Courtney Joe D-CT-2 Introduced 01242019 Committees. Section 2206 of the CARES Act amended Code Section 127 to allow an employer to pay for all or part of an employees Qualified Education Loan as. Make tax-advantaged contributions to employee retirement plans when employees make their student loan payments.

Source: apa.org

Source: apa.org

The CARES Act. So if you have private. Student Loan Repayment. The CARES Act. HR748 - CARES Act 116th Congress 2019-2020 Law Hide Overview.

Source: studentloanhero.com

Source: studentloanhero.com

Thats right there are hospitals out there that will pay for your nursing school tuition without charging you any interest. However for these payments to be excluded from taxable wages they must be made under a tuition assistance plan established under IRC Section 127 and meet the following. Although there might be some student loan options available to you you might want to consider looking into hospitals that pay for nursing school. Education technology company Chegg disburses up to 5000 a year to entry-level and manager-level employees in the US. Fidelity Investments offers a 2000 reimbursement package distributed over five years to employees who pass the six-month mark at the firm.

Source: mobile.twitter.com

Source: mobile.twitter.com

Courtney Joe D-CT-2 Introduced 01242019 Committees. That rate is a sharp dip from pre-pandemic years and will inevitably increase as interest rates rise from zero and. Student Loan Interest Deduction at a Glance. Make matching contributions to retirement plans when employees make student loan payments. Federal Student Aid.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title cares act student loan reimbursement by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.